CEC releases Audited Results for the Financial Year Ended 31 December 2024

Managing Director, Owen Silavwe, commented:

“I am pleased to present CEC’s performance results for the year 2024. Our achievements reflect a strong commitment to our values and strategy, despite the challenges being experienced in the power sector, particularly the effects of the drought that have been felt across the Country while in the region, a historical supply gap is yet to be fully addressed. Through operational resilience and effective strategy execution, we sustained power supply to our customers, leveraging our own generation and third-party sources locally and regionally.

Our delivery of a strong financial performance was driven by prudent capital allocation, effective management of our cost base including impairments, and our ability to meet the growing customer demand. Operational excellence, coupled with an unwavering commitment to safety and environmental stewardship, remains at the core of our performance. While we achieved 1.6 million man-hours without a lost-time accident—slightly lower than our 2023 record—we continue to enhance safety through ongoing proactive engagement with employees and contractors while seeking continuous improvements in our processes and procedures. Our focus on delivering for our shareholders is evident in our financial performance leading to an 8.8% increase in dividend payout year-on-year.

We have made significant progress in executing our strategic plan for the period up to 2027. In pursuit of sustainable growth, we grew our customer base in our markets while continuing to assess a number of new growth opportunities in existing and new markets. Our ongoing investments in modernisation and expansion of power infrastructure to enhance our services and grow our customer base are at the heart of our strategy. In 2024, we enhanced our transmission capacity on the Zambia – DRC interconnector through the installation of voltage support equipment, strengthening and creating further opportunities for competitive regional power trade. Additionally, we continue to advance our renewable energy agenda with planned investments in two medium sized solar PV power plants besides our flagship 136MW Itimpi II solar PV project, currently under construction. The two medium-sized solar PV projects include the 12.5MW Fitula solar PV project and the 20MW Garneton South solar PV project, both located in Kitwe. The Garneton South solar project is being done under the GET FiT Solar program while the Fitula solar PV project is a joint venture with one of our mine customers.

Our commitment to sustainable energy solutions is further demonstrated through the renewable energy agenda being pursued through our subsidiary, CEC Renewables. In this regard, in the first quarter of 2024, we successfully commissioned the 60MW Itimpi I Solar PV Plant and issued the second tranche of our USD200 million Green Bond, equivalent to USD96.7 million in December 2024. The proceeds of this bond will be used to fund the development of the Itimpi II Solar PV Plant. Once commissioned in early 2026, the Itimpi II solar PV plant will increase the total generation capacity under CEC Renewables to 230MW. The strong investor response to our Green Bonds, witnessed thus far, underscores the appetite of the market for such investments and their confidence in the CEC vision.

With the mining sector in Zambia experiencing a positive turnaround coupled with the continued growth we are seeing in the DRC, we are committed to enhancing our position as a reliable energy partner to drive and support customer business turnaround and growth strategies in both markets. We will pursue a disciplined investment approach, and strategic risk management while adopting creative and innovative solution provision to ensure consistent delivery of value across our stakeholder base”.

Financial Highlights

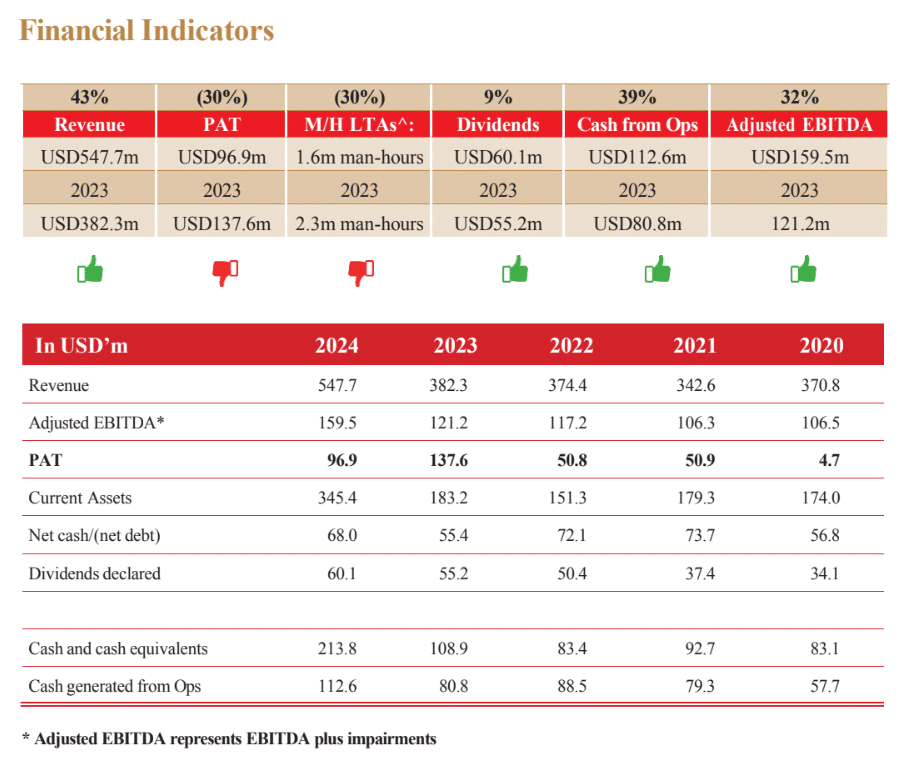

Group revenue increased by 43% to USD547.7 million (2023: USD382.3 million) driven mainly by higher regional power sales, local powersales, and wheeling services of 130%, 14%, and 9% respectively.

The profit for the year was USD97.0 million, which represents a decrease of 30% from USD137.6 million in 2023. The 2023 results were driven by two one-off transactions being the writeback of the previously impaired receivables from Konkola Copper Mines (“KCM”), and the impairment of the investment in the Kabompo Hydropower project of USD171.6 million and USD35.4 million respectively.

The cash balance as at 31 December 2024 was USD213.8 million (2023: USD108.9 million). This was driven by the issuance of the second tranche of the green bond of USD96.7 million in December 2024.

The Group, having addressed some of the key uncertainties it had faced and backed by both the dividend policy and the strength of the financial performance, declared and paid an interim dividend of USD60.1million, which represents an 8.8% increase over the 2023 dividend distribution of USD55.2 million.

Cautionary on Forward-looking Information

This summary results announcement contains financial and non-financial forward-looking statements about the Company’s performance and position. We believe that while all forward-looking information contained herein is realistic at the time of publishing this report, actual results in future may differ from those anticipated. These forward-looking statements involve known and un-known risks, uncertainties and other factors that may cause CEC’s actual results, performance or achievements to differ materially from the anticipated results, performance or achievements expressed or implied by these forward-looking statements. Although CEC believes that the expectations reflected in these forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. We take no obligation to revise or update these forward-looking statements to reflect events or circumstances that arise after the statements have been made.

About the Company

CEC’s core business is the supply of power to the copper mines in the Copperbelt Province of Zambia and the DRC. CEC provides the transmission use of system and wheels power through its network on behalf of ZESCO Ltd and other users in Zambia and the Southern Africa Power Pool. The Company operates a transmission interconnection with the DRC. CEC has five incorporated subsidiaries – CEC DRC Sarl, CEC-Garneton South, Fitula Solar, CEC Renewables Limited and Power Dynamos Sports Limited (PDSL). CEC-DRC Sarl is a special purpose vehicle incorporated to secure the power trading segment and grow the Company’s interest in the DRC market. PDSL is a special purpose vehicle that runs Power Dynamos Football Club.

By Order of the Board Julia C Z Chaila (Mrs.)

Company Secretary

Related Downloads