CEC releases Unaudited Results for the Half Year Ended 30 June 2022

CEO, Owen Silavwe, commented:

“I am pleased that these half year results are being released against a backdrop of an improving business environment more supportive of private sector investment. From improving macro-economic conditions to noticeable efforts by the government to deepen dialogue between the public and private sectors through multiple approaches including the Public Private Dialogue Forum. Building on the opportunities offered by an improving business environment, we continue to enhance our relationships and communication with all stakeholders alongside resolving historical issues that have posed risks to the business in the last three years.

We have made considerable progress on a number of important commercial matters. One of the key milestones we have achieved during the period is the signing of a new Bulk Supply Agreement with ZESCO, tenured at 13 years with mutually beneficial terms. Working with all the other sector players including the mines, Energy Regulation Board and ZESCO, we are making considerable progress in finding a negotiated sector-wide solution to the 2014 tariff impasse that has remained an active court matter and inundated industry over the last eight years. While progress has been slower than anticipated, we are confident that we will continue to work collaboratively to achieve a conclusive settlement in the not-too-distant future. Despite the great progress we have made so far on multiple fronts, the Konkola Copper Mines contractual issues and associated growing debt levels are key commercial matters that are still far from resolution. Arbitral proceedings relating to this matter that commenced in 2021 are continuing.

We are accelerating the pace of strategic and operational progress for our business while maintaining best-in-class safety and reliability levels across our power network. During the half, we maintained a world class benchmark performance in the areas of safety, health and environment achieving an injury frequency rate of 0.18. Despite this strong performance, our zero lost time accident record that we have run over the last 6 years suffered a dent following the occurrence of two lost-time accidents. Investigations and detailed reviews of these occurrences were carried out resulting in further assurance checks being put in place. We continue to focus on building a sustainable safety culture across our operations. Managing high quality, long term assets based on long term contracts and the evolving regulatory environment alongside embedment of an effective risk management framework targeted at continuously minimising business risk is key to the delivery of value to our stakeholders. We are continuing to invest in our power network, achieving asset upgrades and modernisation that is enabling more efficient and reliable service delivery for our customers.

The total energy demanded by our customers and transmitted through our network was 3,460.77 GWh compared to 3,230.14GWh the same period in 2021, a growth rate of 7.1%. This covers demand across all our business segments including local power supply, domestic and international wheeling, transmission use of system and regional power supply. We expect the upward trend in demand to continue backed by a bullish copper price outlook over the medium term and more specifically underpinned by expected production ramp up in both the Zambian and DRC markets. Demand of about 100MW from our newly signed power supply agreements with customers in Zambia and the DRC should begin to materialize in 2023 and ramp up to full capacity over a two-year period as we commission new infrastructure that is the subject of various projects including Macrolink, Mimbula and Lonshi, currently under implementation.

Growing demand across business segments led by our regional power demand is powering impressive growth in our financial performance as highlighted above. We expect this performance to be replicated in the second half of the year, to cap what we are forecasting to be another successful year for the business.

We remain an active participant in various workstreams aiming to reform and move the market to the next phase of development. Currently active workstreams extend from work on the market design and open access, the multi-year tariff framework to the work aiming to put in place a first integrated resource plan for Zambia. If done properly, the outcome of these workstreams should be to attain improved efficiencies in the sector, provide equitable access to the transmission network to all users, enhance competition, and drive increased private sector investments.

The business is seeing great growth prospects going into the future based on its strategic focus areas that include supplying expansionary and new demand by mine customers in all our markets, investing in new transmission and distribution capacity encompassing expansion of existing alongside building new transmission infrastructure such as regional interconnectors, and investing in renewable energy sources to continue strengthening our supply portfolio. Currently our project pipeline includes projects in all the three categories. Infrastructure projects to connect three new mine customers in our markets are progressing well following successful negotiations and signing of supply contracts. We operate in an industry where the pace of change is accelerating with increased focus on decarbonisation, digitalisation and decentralisation. Our strategy is increasingly being adapted to reflect these changes. Our approved flagship solar projects are at different stages of implementation. The 34MW Riverside solar project, which is under construction, has reached an advanced stage with commissioning scheduled for December 2022 while the 60MW Garnerton solar project is currently at procurement stage. We are working with our partners with the aim of adding significant transmission capacity to facilitate further growth opportunities of the power trading activity. This workstream is currently at planning stage, firming up on the technical and investment requirements. As we pursue growth opportunities, we aim to maintain a disciplined approach to our investment in power infrastructure and in pursuit of any opportunities that are in support of our core business.”

Financial Highlights

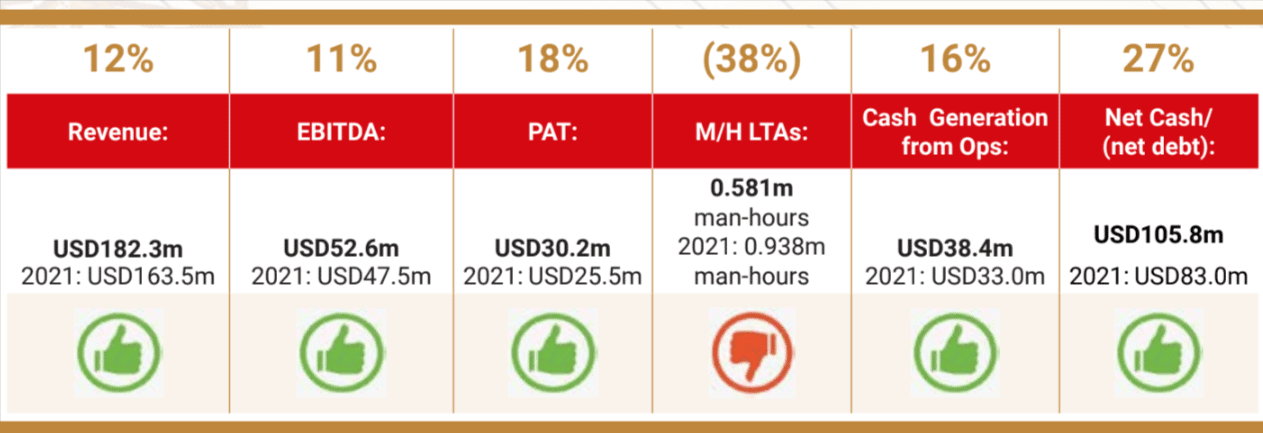

Total revenue for the 6-month period to 30 June 2022 was USD182.3 million, 12% above the comparative period last year and primarily driven by growth in our regional power supplies which grew by more than 28%, anchored on increase in volume sales of 22% and robust power sourcing arrangements.

The profit for the period was USD30.2 million, which represents growth of 18% from USD25.3 million in 2021. Despite the period under review recording a higher profit, there was a 201% increase in the impairment of receivables to USD9.6 million from USD3.2 million, computed in accordance with International Financial Reporting Standard 9. The Kwacha appreciated against the major currencies and specifically by about 21% against the US dollar when compared to 2021. The consequence of the strong Kwacha was an effective increase of Kwacha denominated costs by 20% from USD17.2 million to USD20.6 million. The other costs continue to be contained through continuous cost-management initiatives.

Headline earnings for the 6-month period increased by 12% with earnings per share growing from USD0.016 per share to USD0.019 per share.

There was an improvement in cash generation from operations to USD38.4 million (2021: USD33.0 million) and a cash balance of USD103.0 million (2021: USD105.9 million).

The Company dividend policy provides for a pay-out of a minimum of 50% of the earnings, subject to the availability of cash, and reserves and having provided sufficiently for sufficient working capital and any other obligations.

Similar to the financial year 2021 no dividend was declared and paid during the period under review. However, the Company remains committed and will continue to deliver a consistent and reliable dividend to its shareholders on an annual basis.

Cautionary on Forward-looking Information

This summary results announcement contains financial and non-financial forward-looking statements about the Company’s performance and position. We believe that while all forward-looking information contained herein is realistic at the time of publishing this report, actual results in future may differ from those anticipated. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause CEC’s actual results, performance or achievements to differ materially from the anticipated results, performance or achievements expressed or implied by these forward-looking statements. Although CEC believes that the expectations reflected in these forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. We take no obligation to revise or update these forward-looking statements to reflect events or circumstances that arise after the statements have been made.

About the Company

CEC’s core business is the supply of power to the copper mines in the Copperbelt Province of Zambia and the DRC. CEC provides the transmission use of system and wheels power through its network on behalf of ZESCO Ltd and other users in Zambia and the Southern Africa Power Pool. The Company operates a transmission interconnection with the DRC.

CEC has five incorporated subsidiaries – CEC-Kabompo Hydro Power Limited (CEC-KHPL), CEC DRC Sarl, CEC-InnoVent South, InnoVent-CEC North and Power Dynamos Sports Limited (PDSL). CEC-KHPL is the special purpose vehicle through which CEC has been pursuing the development of the Kabompo Gorge hydroelectric power project in Mwinilunga District of the North-Western Province of Zambia, while CEC-DRC Sarl is a special purpose vehicle incorporated to secure the power trading segment and grow the Company’s interest in the DRC market. PDSL is a special purpose vehicle which runs Power Dynamos Football Club.

By Order of the Board

Julia C Z Chaila (Mrs.)

Company Secretary

Related Downloads